Miles Unterreiner

Policy Associate

One in 20 Americans has an error on one or more of their credit reports that could affect the prices they pay for financial products. Big Credit Reports, Big Complaints - the third in a series of analyses of the Consumer Financial Protection Bureau's (CFPB) Consumer Complaint Database - documents the frequent problems consumers experience with credit reports, as well as the major credit bureaus' responses to consumer complaints. It shows that the CFPB complaints process has helped thousands of consumers fix erroneous information on their credit reports, obtain the free annual credit reports to which they are legally entitled, and obtain other forms of relief from major credit bureaus.

Policy Associate

Associate Director and Senior Policy Analyst, Frontier Group

Senior Director, Federal Consumer Program, U.S. PIRG Education Fund

The Consumer Financial Protection Bureau was established in 2010 in the wake of the worst financial crisis in decades. Its mission is to identify dangerous and unfair financial practices, educate consumers about these practices, and regulate the financial institutions that perpetuate them.

To help accomplish these goals, the CFPB has created and made available to the public the Consumer Complaint Database. The database tracks complaints made by consumers to the CFPB and how they are resolved. The Consumer Complaint Database enables the CFPB to identify financial practices that threaten to harm consumers and enables the public to evaluate both the performance of the financial industry and of the CFPB.

This report is the third of several that review complaints to the CFPB nationally and on a state-by-state level. In this report, we explore consumer complaints about credit bureaus with the aim of uncovering patterns in the problems consumers are experiencing with credit reporting.

The three nationwide consumer reporting agencies (NCRAs) – Equifax, TransUnion and Experian – collect, centralize and aggregate information about the credit and repayment records of consumers. They source this information from public databases – including court records, state and federal tax liens, and bankruptcy records – and from a wide variety of private actors, called “furnishers,” who forward consumer credit information to them voluntarily. The NCRAs then distribute the information to “users” – often companies providing financial products, from student loans to credit cards to mortgages – who use the information to evaluate consumers’ eligibility for financial services. Increasingly, reports are also being used for employment and insurance purposes. In addition to the three NCRAs, a large number of “specialty” consumer reporting agencies track a variety of specialized information; for example, some collect information on whether consumers have written bad checks to merchants or left banks with negative balances, while others may screen tenants based on previous evictions, and still others review public records or other histories of employment applicants.

Since the Consumer Financial Protection Bureau began collecting complaints about credit reporting in October 2012, the CFPB has recorded more than 10,000 complaints about credit reporting.[i]

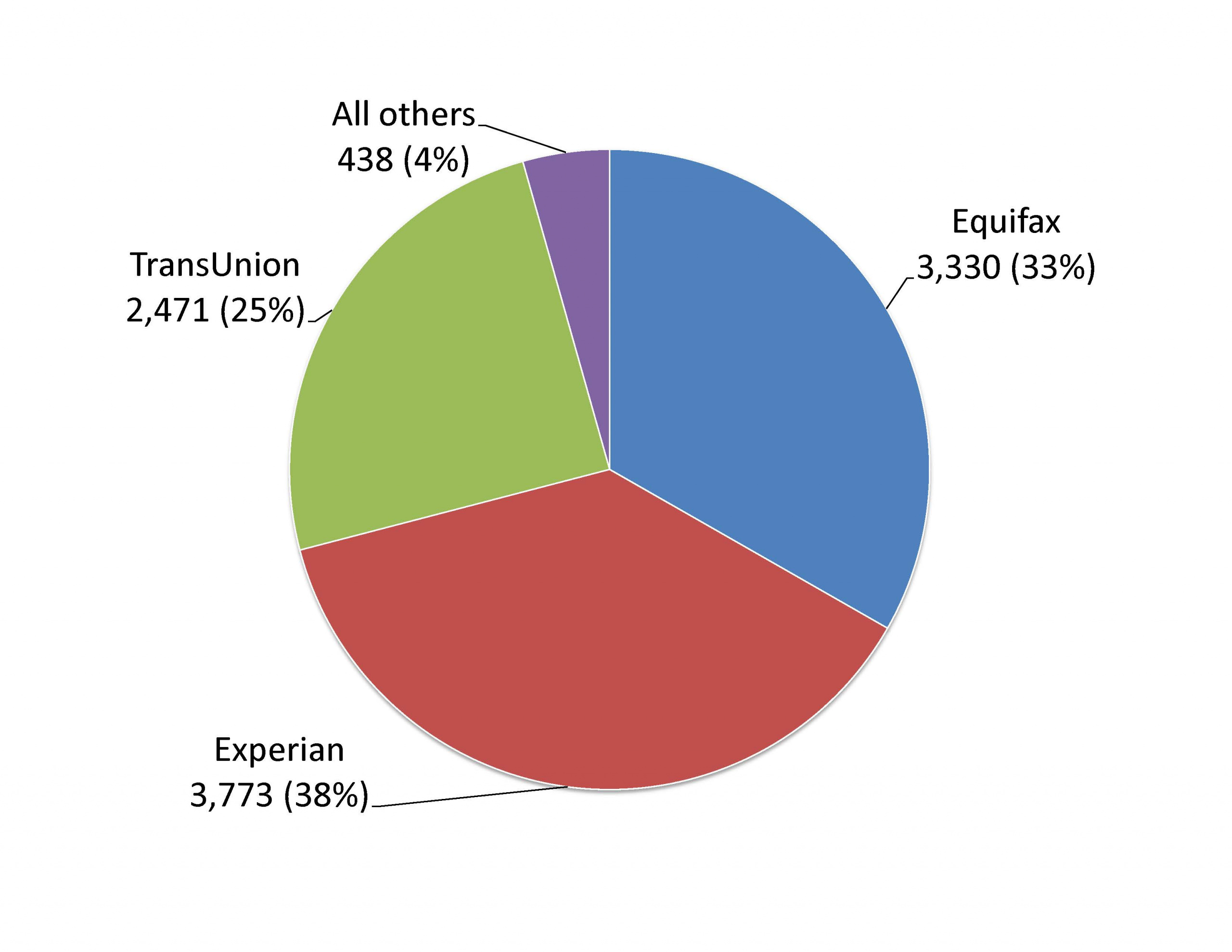

Figure ES-1. The Three NCRAs Account Collectively for 96 Percent of Complaints to the CFPB About Credit Reporting

Figure ES-2. Consumers Are Most Likely to Complain about Having Incorrect Information on Their Credit Report

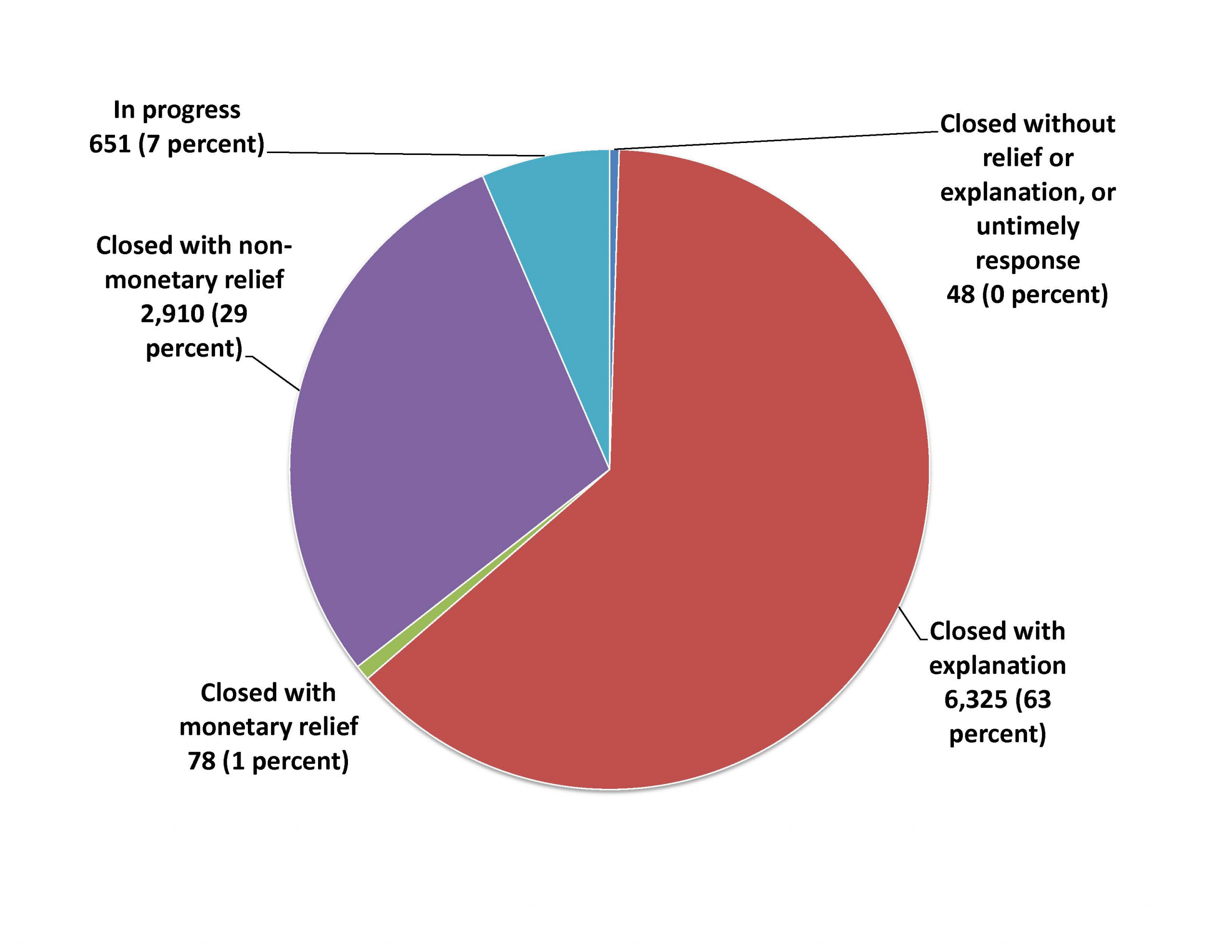

Figure ES-3. Nearly 3,000 Consumers Received Relief after Complaining to the CFPB

The three NCRAs reported very different responses to consumer complaints.[ii]

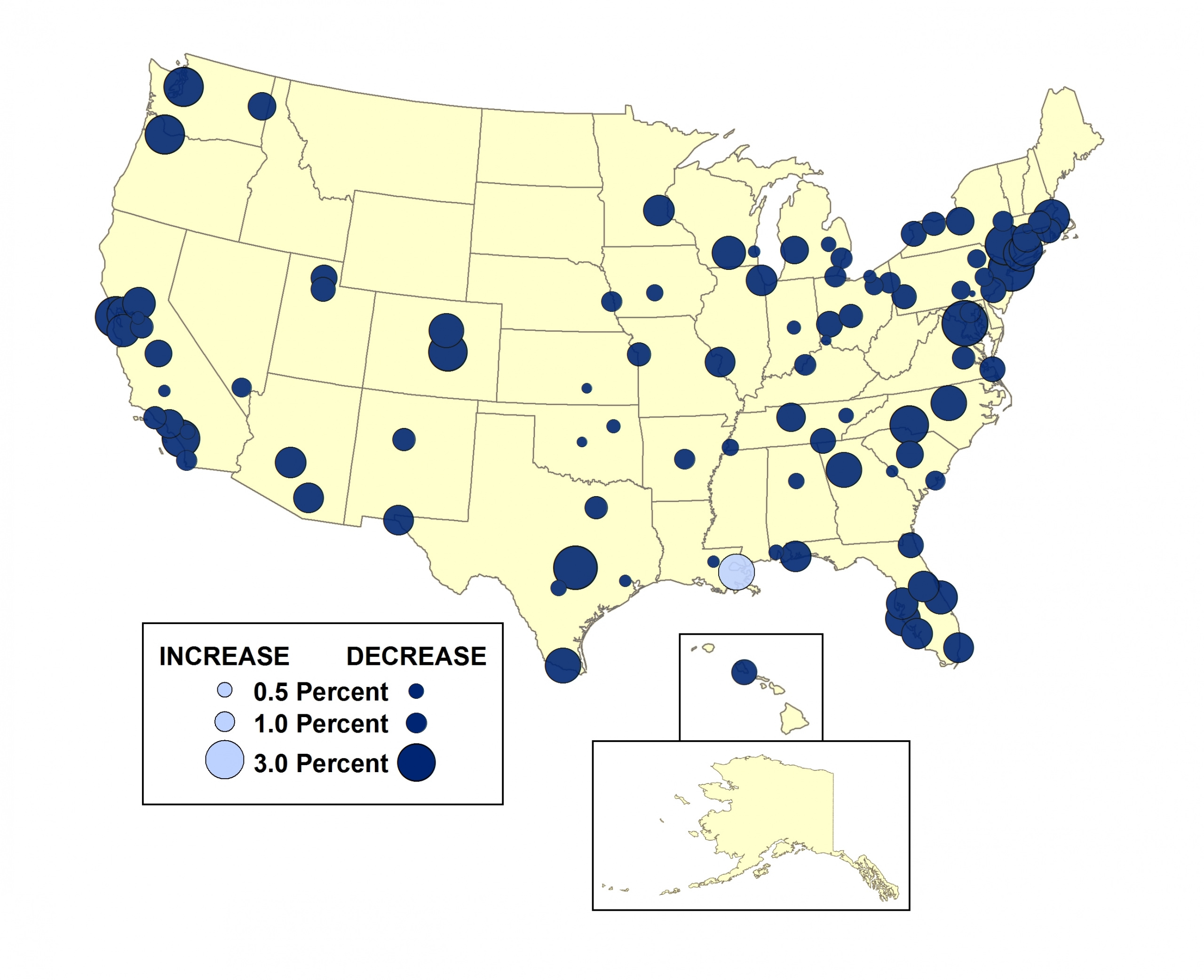

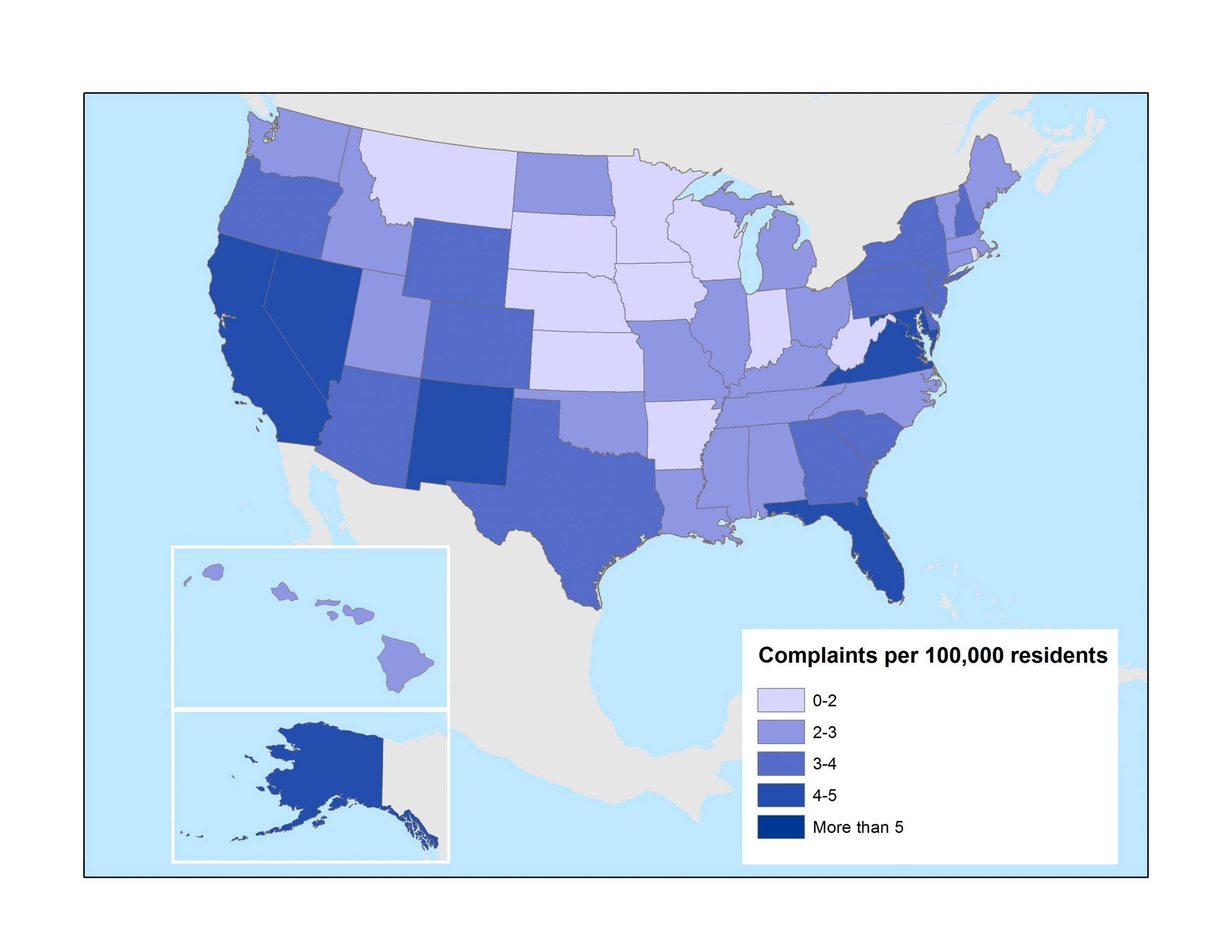

Figure ES-4. Credit Reporting Complaints per 100,000 Residents

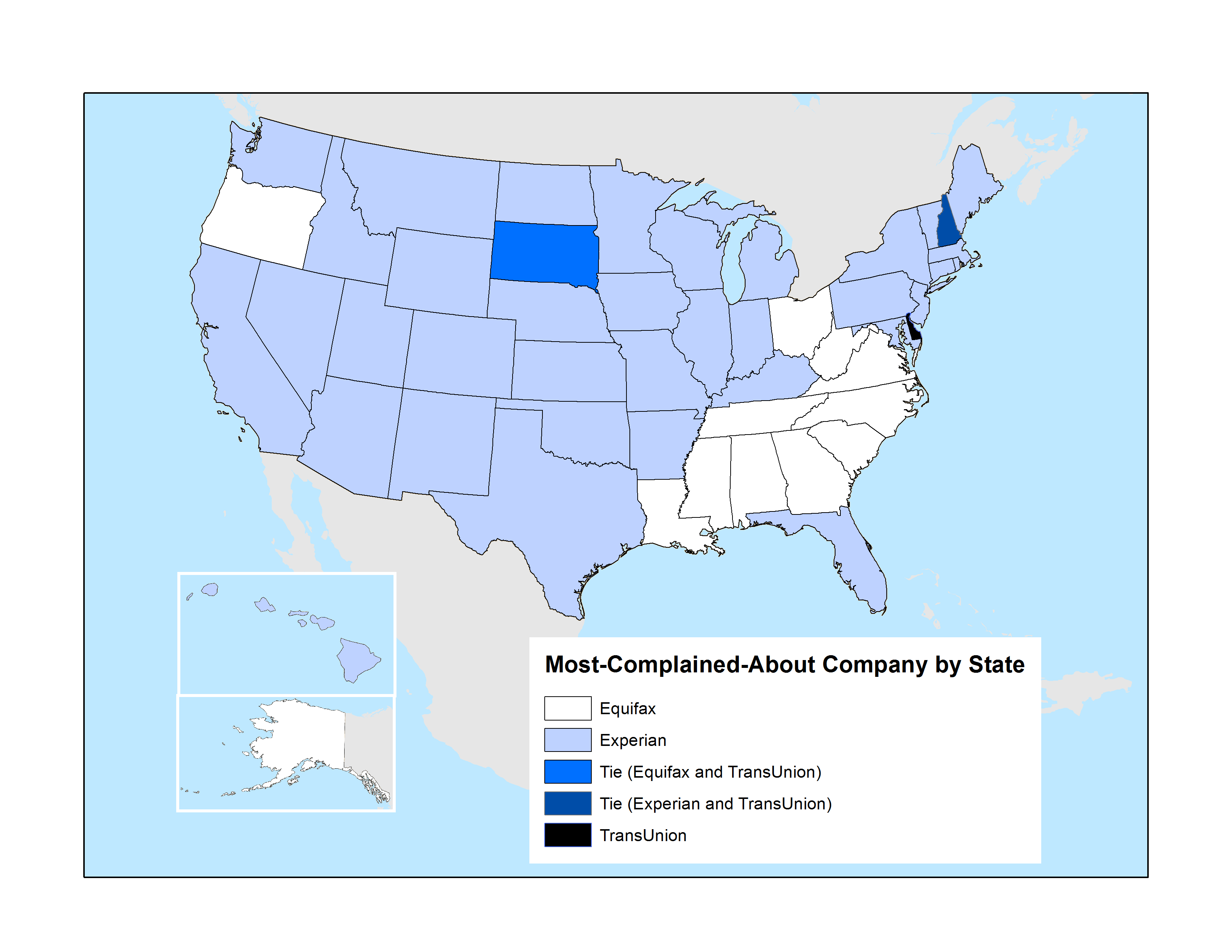

Figure ES-5. Most Complained-about Credit Bureau by State

The Consumer Financial Protection Bureau’s Consumer Complaint Database is a key resource for consumer protection. To enhance the effectiveness of the CFPB in addressing consumer complaints:

To improve the effectiveness of the CFPB, the agency should:

[i] As of August 26, 2013.

[ii] Company response type is self-reported.

Policy Associate

Tony Dutzik is associate director and senior policy analyst with Frontier Group. His research and ideas on climate, energy and transportation policy have helped shape public policy debates across the U.S., and have earned coverage in media outlets from the New York Times to National Public Radio. A former journalist, Tony lives and works in Boston.

Ed oversees U.S. PIRG’s federal consumer program, helping to lead national efforts to improve consumer credit reporting laws, identity theft protections, product safety regulations and more. Ed is co-founder and continuing leader of the coalition, Americans For Financial Reform, which fought for the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including as its centerpiece the Consumer Financial Protection Bureau. He was awarded the Consumer Federation of America's Esther Peterson Consumer Service Award in 2006, Privacy International's Brandeis Award in 2003, and numerous annual "Top Lobbyist" awards from The Hill and other outlets. Ed lives in Virginia, and on weekends he enjoys biking with friends on the many local bicycle trails.