Why Young Invincibles Should Sign up for Health Insurance

As health insurance enrollment required by the Affordable Care Act begins in earnest, I’ve seen plenty of press coverage questioning if young people will buy insurance as the Obama administration hopes, or if “young invincibles” will take their chances and go without. Most of the media coverage centers on how the participation of young people is essential for the financial longevity of our health care system. I think there’s another, stronger reason why young invincibles should get health insurance: their own financial well-being.

As health insurance enrollment required by the Affordable Care Act begins in earnest, I’ve seen plenty of press coverage questioning if young people will buy insurance as the Obama administration hopes, or if “young invincibles” will take their chances and go without. Most of the media coverage centers on how the participation of young people is essential for the financial longevity of our health care system.

I think there’s another, stronger reason why young invincibles should get health insurance: their own financial well-being.

Insurance provides protection against the catastrophic—and in health care, costs are so high that almost any health issue but a routine check-up can be financially catastrophic. I didn’t realize this until I was 29 years old—a peer of the young invincibles—and broke my leg. For my first two-and-a-half decades of my life, I’d had no health problems and my parents or I could have paid for my health care without insurance.

But on a bright Sunday morning, I fell off my bike, breaking my lower leg. Some good Samaritans took me to the nearest emergency room, where the sight of my twisted leg prompted the nursing staff to admit me before everybody in the full waiting room. After surgery to screw my leg back together and a three-day hospital stay, I was released. In the coming months, I made innumerable follow-up trips to the doctor.

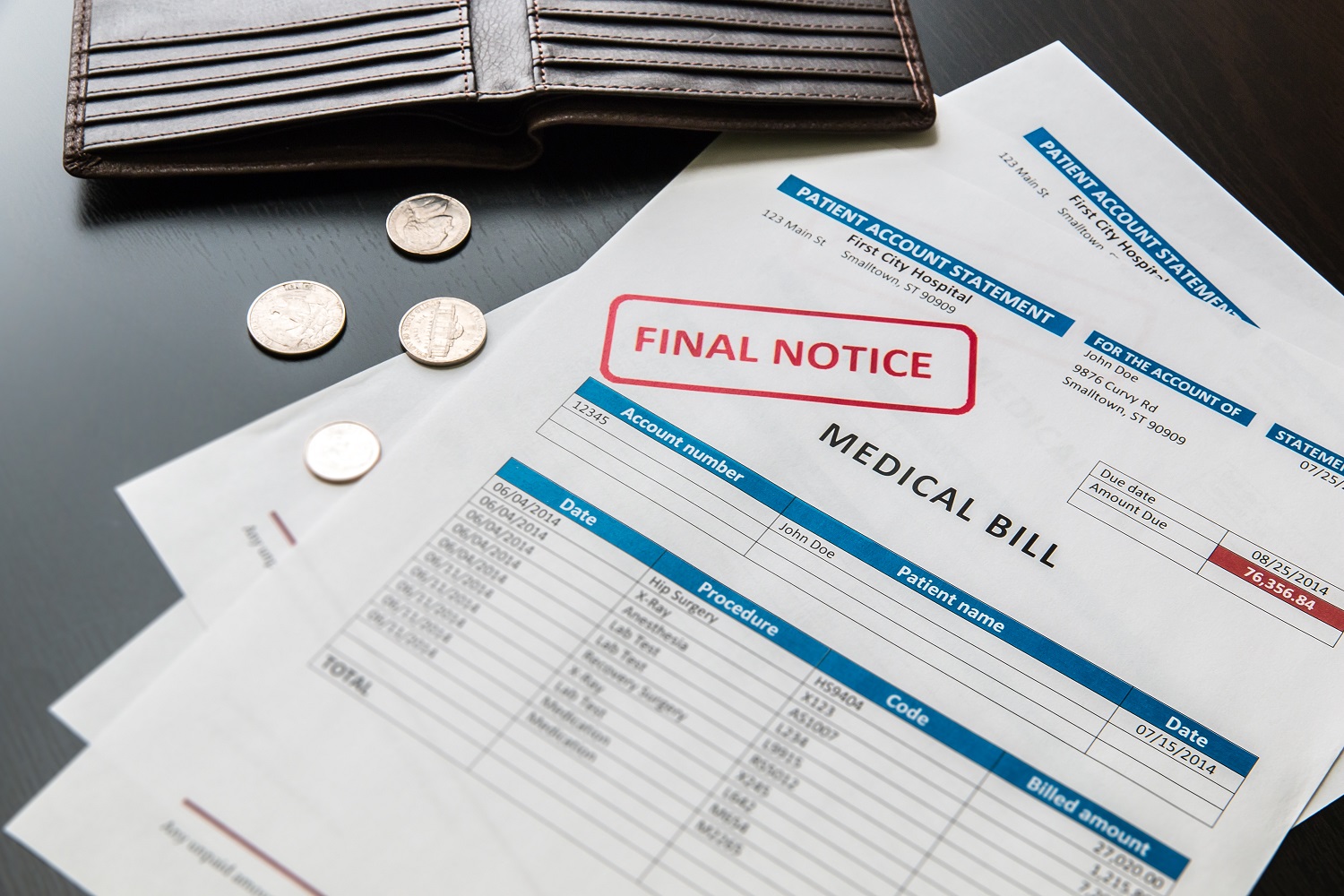

I estimate that the total cost billed to my insurance company neared $60,000, including $40,000 to $50,000 for my surgery and hospital stay, and thousands more for various expenses after that. Those expenses included $400 per weekly visit to the plastic surgeon (because it looked like I might need a skin graft) and nearly $1,000 for a removable cast.

When my husband opened up the first “statement of benefits” from the insurance company showing how much the hospital had charged for my surgery and stay, he said “if we didn’t have insurance, we could lose our house over this.” I had quality insurance, though, and our out-of-pocket expenses—from hospitalization through physical therapy—were probably less than $2,000. My insurer probably paid far less than $60,000, thanks to its ability to negotiate discounts with health care providers, but without insurance I would have been expected to pay $60,000.

I was a young invincible on a bike ride (reducing my future health care costs, I’ll note, by cutting my risk of heart disease and diabetes) that didn’t end as I expected. I was fortunate to have insurance (provided by my employer) that protected my family’s financial well-being. Now that the Affordable Care Act has put insurance within reach of all young invincibles, I hope they sign up.

Topics

Authors

Elizabeth Ridlington

Associate Director and Senior Policy Analyst, Frontier Group

Elizabeth Ridlington is associate director and senior policy analyst with Frontier Group. She focuses primarily on global warming, toxics, health care and clean vehicles, and has written dozens of reports on these and other subjects. Elizabeth graduated with honors from Harvard with a degree in government. She joined Frontier Group in 2002. She lives in Northern California with her son.

Find Out More

Developing the antibiotics we need

How useful are hospital price transparency tools?

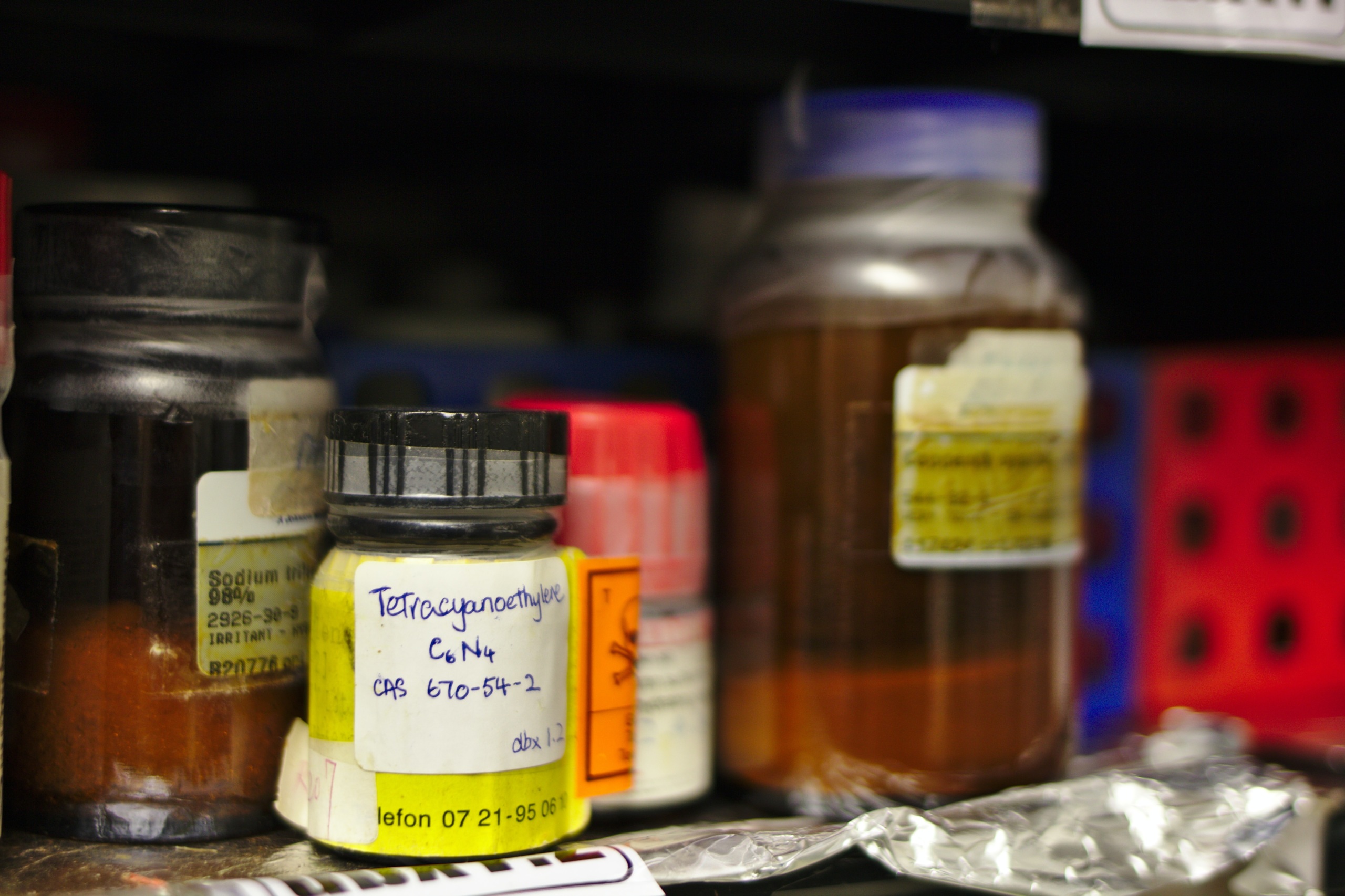

More and better testing would protect us from chemical threats