How useful are hospital price transparency tools?

New hospital price transparency requirements don't provide the information consumers need.

In August, my teenage son fell and scraped a large chunk of skin and flesh off his knee during a weekend run with his high school cross-country team. A team doctor cleaned and bandaged the wound, and recommended against stitches. But when the wound hadn’t quit bleeding a few hours later, we went to the emergency room.^ At the ER, the staff cleaned out even more gravel, x-rayed the knee to confirm no structural damage, and gave him two stitches, along with a brace to keep him from bending his knee.

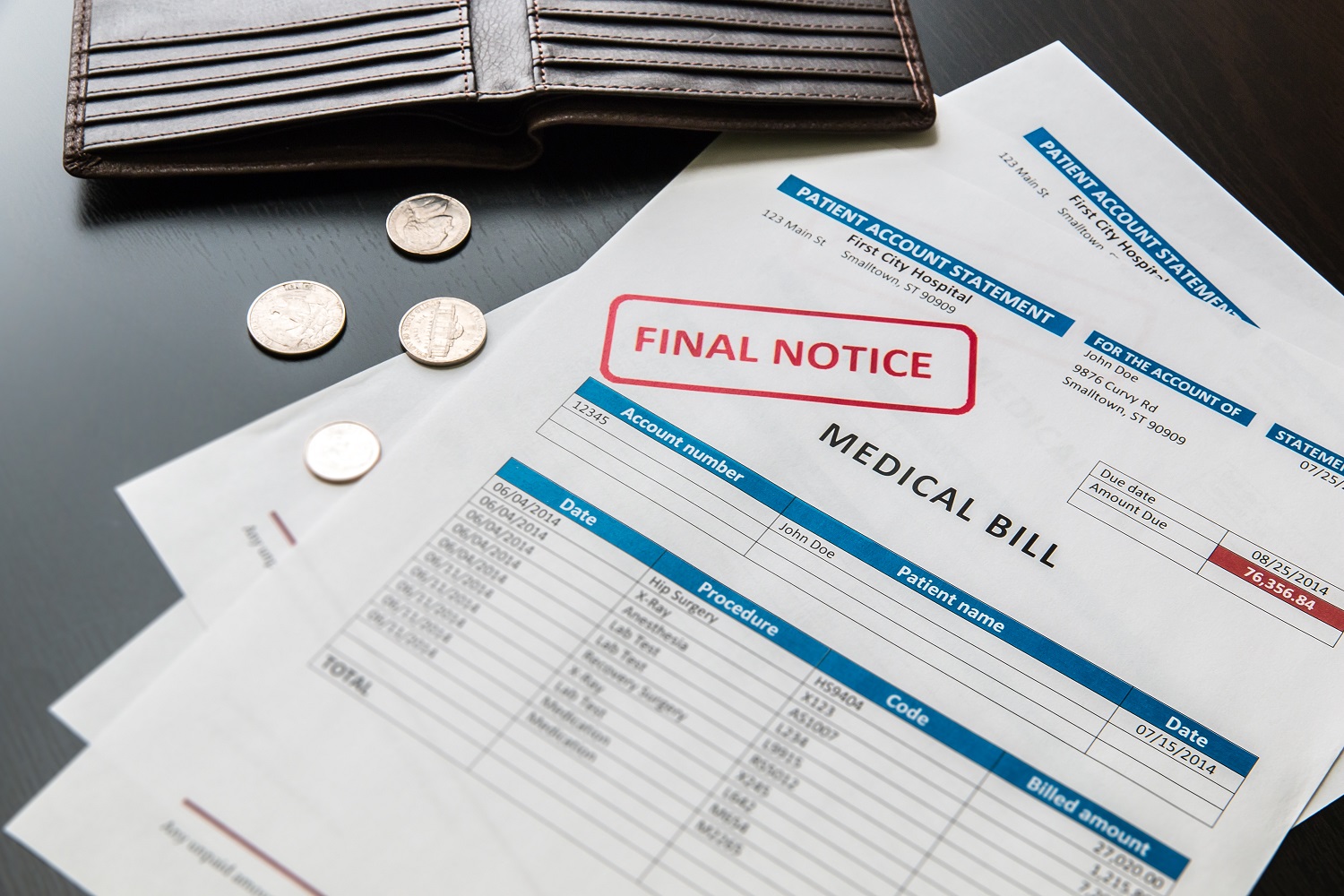

A week later, we received notice that the hospital billed $7,000 for this care.*

Thankfully, my employer-provided health care coverage paid almost all of the cost, but because this seemed like an outrageous amount of money to pay for relatively modest care, I wanted to know more: Was this in line with what other hospitals charge for this type of care? How much would we have paid if we had a higher deductible, or if we didn’t have insurance at all and had just paid with cash?

I hoped this would be easy, thanks to a new federal requirement that hospitals disclose their prices online. It wasn’t easy at all, and ultimately, I couldn’t find the price information I was looking for.

Since the beginning of 2021, the federal government has required hospitals to post price information on their websites. Hospitals must provide a list of standard charges for the medical services they provide in a machine-readable format. They must also make available in a patient-friendly format the price of 300 common planned services – the sort of care that patients might anticipate and shop around for. The information is supposed to include plain-language descriptions and common procedural codes to enable patients to search for and identify the price of the exact service they need whether they’re using insurance or paying out of their own pocket.

At my request, the hospital where my son was treated sent me an itemized bill with procedural codes. (A shout-out to Marshall Allen for his book “Never Pay the First Bill” for tips on how to respond to and decipher a hospital bill.)

In what perhaps should have been a tip-off that this process wasn’t going to be simple, the codes provided on the bill from the hospital turned out not to be standard industry-wide codes, but codes used by that specific hospital. Eventually, I managed to figure out the correct standard codes myself.

I already knew how much the hospital had actually charged us for my son’s ER visit, and I was curious to know if the prices shown by the online transparency tools would match. They didn’t.

In the list of standard charges, which is also supposed to include insurance-specific negotiated prices, I found the insurance price for only one of the four services my son received. When I searched for the cash price, I discovered that the hospital’s list of standard charges showed a different cash price than its patient-friendly price-estimator tool. Paying cash for a knee x-ray with three views, for example, would have cost $1,317 according to the machine-readable standard charges list and $650 according to the patient-friendly tool. This might reflect the difference between outpatient versus inpatient settings or planned versus emergency service, but I couldn’t confirm that.

I also wanted to know if a different hospital might have charged less, so I looked at the websites of two other hospitals. I couldn’t find enough information to ascertain whether either hospital would have been cheaper. At the first alternative hospital, the cash price was lower for the two services for which there was information, but that hospital didn’t show a negotiated rate specific to our insurance. At the third hospital, we would have saved money if we had been paying with cash, but too much information was blank or “N/A” for me to be able to calculate what our insurance would have been charged.

Even if I had managed to calculate a likely price from each hospital’s online information, those estimates might not have been entirely reliable. A new study led by academic researchers at the University of Texas found a poor correlation between the cash prices posted on the websites of 60 hospitals across the country and the prices quoted to secret shoppers who inquired by phone.

For a brain MRI, for example, more than a quarter of the 47 eligible hospitals surveyed quoted prices over the phone that differed from those listed online by more than 50%. At only one-fifth of the 47 hospitals did the online and phone price for a brain MRI match exactly. Sometimes the online prices were higher and sometimes the phone prices were higher – meaning that even if I had been able to find all the price information that I’d been looking for online, it might not have meant much.

I found the lack of transparency that I encountered in my search frustrating, and I wasn’t even trying to plan for a future expense. It’s truly disheartening that hospitals themselves, according to this latest study, seem not to know how much they are going to charge for a common service.

The high cost of health care is a major burden for patients and often deters people from seeking care. Price transparency requirements are intended to help patients search out less expensive care or at least anticipate how much their care will cost. However, the current level of disclosure by hospitals is inadequate for either of these purposes.

As a parent, the financial lesson I learned from my son’s fall on a gravel road is that hospital price transparency tools aren’t yet able to provide the information that patients need. As an advocate, I learned that there’s still more work to be done to protect patients’ financial interests.

^ We might have gone to urgent care, except that there are no nearby urgent care facilities with weekend hours that are covered by our insurance network.

* A whole additional round of health care billing ridiculousness appeared in late September when we received another bill related to my son’s ER visit. This invoice was for the physician’s time. It had multiple problems: 1) The physician staffing service coded my son’s injury at a higher level of severity than the hospital did. I don’t know if that was a mistake or upcoding – fraudulently claiming his condition was more severe than it actually was in an attempt to get paid more. 2) The bill from the physician staffing firm lists a smaller insurance-negotiated discount than what the explanation of benefits from my insurance company shows. 3) My insurance company already paid what it thought was the right amount, and now the physician staffing firm is trying to get me to pay the rest. After three phone calls and an hour of my time, I’ve been assured that everything will be straightened out.

Topics

Authors

Elizabeth Ridlington

Associate Director and Senior Policy Analyst, Frontier Group

Elizabeth Ridlington is associate director and senior policy analyst with Frontier Group. She focuses primarily on global warming, toxics, health care and clean vehicles, and has written dozens of reports on these and other subjects. Elizabeth graduated with honors from Harvard with a degree in government. She joined Frontier Group in 2002. She lives in Northern California with her son.

Find Out More

Developing the antibiotics we need

More and better testing would protect us from chemical threats

The high cost of medical care leaves consumers vulnerable