Is Individual Car Ownership Dying? And Is Leasing Helping to Kill it?

The trend toward vehicle leasing is consistent with what appears to be a broader shift to a “rentership society” and may signal that Americans are willing to change their relationship with their cars from one that is long-term and durable to one that is contingent and flexible.

Other posts in the Mobility on the Installment Plan series:

By Tony Dutzik and Vincent Armentano

On-demand mobility provided by an array of shared-use services, as we wrote in the introduction to this series, has the potential to supplant individual car ownership as the dominant mobility model in the United States. The research of Elliot Martin, Susan Shaheen and others has shown that carsharing and bikesharing programs reduce household vehicle ownership by enabling people to sell or forgo the purchase of a vehicle. Meanwhile, studies suggest that, in a world of shared, driverless cars, the number of vehicles on our roads could be reduced by as much as 90 percent.

Today, however, carsharing and other sharing-economy services remain available only in limited areas of a limited number of American cities. The shared-use revolution is happening, but it has a long way yet to go.

Meanwhile, however, there is another revolution happening in the automobile sector that also shows the cracks in the traditional model of individual car ownership: the rise of leasing. The trend toward vehicle leasing is consistent with what appears to be a broader shift to a “rentership society” and may signal that Americans are willing to change their relationship with their cars from one that is long-term and durable to one that is contingent and flexible.

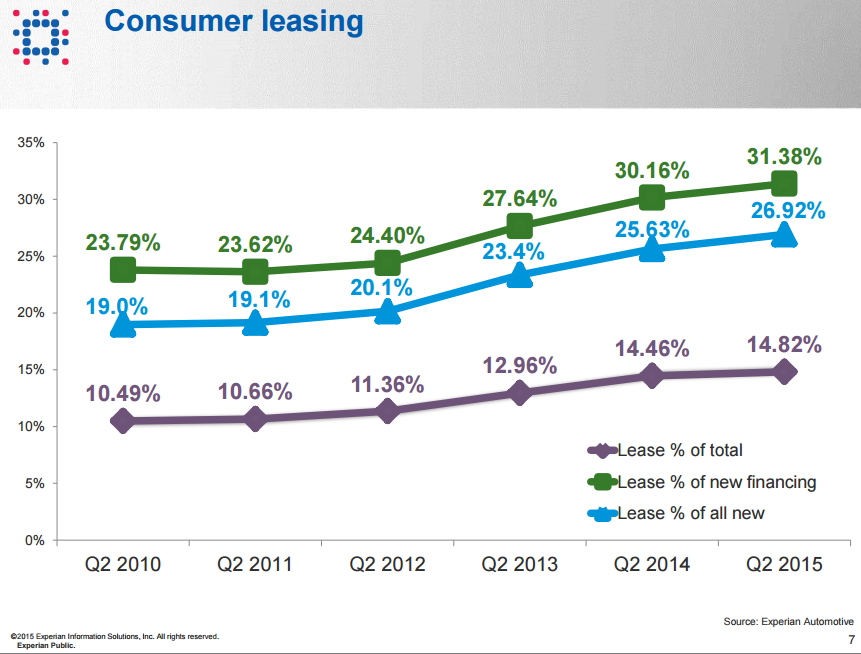

We wrote in our last post about inexpensive lease deals and how they were helping to push the lease penetration rate (the share of new vehicles that are leased) upwards of 27 percent – a dramatic increase from a decade ago. (See chart below.) One particular demographic that is taking advantage of these deals is theMillennial generation. Millennials are leasing at a higher rate than the overall population, with a lease penetration rate of 28.9 percent.

Source: Experian Automotive

Millennials, like other Americans, have been using favorable lease terms to get more car for a lower monthly payment. In a survey performed byEdmunds, 57 percent of Millennials said they were willing to put no more than $2,999 down on a car and 55% said they were willing to pay no more than $299 per month for their monthly payment. Despite the uptick in the economy, many Millennials remain financially constrained – leasing provides a way for them and others to drive new vehicles at relatively low monthly payments.

It is also consistent with broader changes in an economy moving from an ownership to a rental or subscription model for many goods and services. The increase in rental housing, the rise of subscription services such as Spotify, and the recently announced iPhone leasing scheme, which offers the ability to upgrade to a new phone every year, are all examples of how rentership and usership have moved into arenas where ownership once prevailed.

Car dealers have historically tended to love leasing because, in an environment when the average length of an auto loan is over five years, leasing brings customers back to the showroom for new purchases much more frequently.

The flip side, however, is that individuals leasing vehicles are forced to reevaluate their relationship with vehicle ownership – lease, buy, or just turn in and walk away – at fixed intervals of time. With no trade-in value at the time of that transition, that renegotiation has the potential to begin from square one. Might individuals who are rethinking their mobility choices be more likely to make a category shift – from two-car family to one-car household, for example – under such circumstances?

I am not aware of data that suggests that they are. But transportation research tells us that changes in life circumstance – marriage, childbirth, the start of a new job – create opportunities for people to reevaluate their mobility choices. Disruptions in travel routines, whatever their cause, create opportunities for individuals to “reset” their behavior and form new habits. The expiration of a vehicle lease, in theory at least, creates one such resetting opportunity.

All of this leads to some interesting questions: Can the growth of leasing be seen as a baby step toward a new mobility system based around use, rather than ownership, of vehicles? Could the relatively short duration of most leases provide drivers with more frequent “off ramps” from vehicle ownership as the “mobility as a service” model continues to develop? Is there room in the market for products to occupy the wide gap between two- to three-year vehicle leases and hourly/daily carsharing — e.g., subscription-based or fractional ownership models of vehicle access?

In addition, how much of the recent move toward leasing is based in changing preferences versus financial constraints versus the current favorable economics of leasing? How do we understand the growth of leasing when compared with the simultaneous lengthening of terms for auto loans, which could result in many consumers remaining locked in their current vehicles for longer periods of time? And what can be learned from the subprime vehicle market, where high interest rates, the poor credit standing of many buyers, and ease of repossession results in some dealers “selling” the same repossessed vehicles over and over again – creating a perverse (and expensive) form of de facto “rentership”? Might there be another model that provides access to mobility to those who need it that is less exploitative?

The answers to these questions are uncertain, but the recent growth in leasing suggests that the shift away from personal vehicle ownership may be underway. The implications of that shift, and the forms it takes, will have profound implications for how Americans travel in the years ahead.