Highway Spending Is Eating the Budget

The U.S. still spends vast sums of money to build new highways and widen existing ones.

The Federal Highway Administration came out recently with its latest biennial report to Congress on the state of the nation’s highways and transit systems.

If you follow transportation issues at all, you’ve likely heard a lot of talk about the declining state of our roads and bridges. What you haven’t heard much about are the ways in which rising highway expenditures are consuming a greater share of public budgets.

The new federal report sheds some light on the growing burden of highway construction and maintenance by tracking trends in spending from 2002 to 2012. Here are a few important points:

1) We’re Spending More on Highways

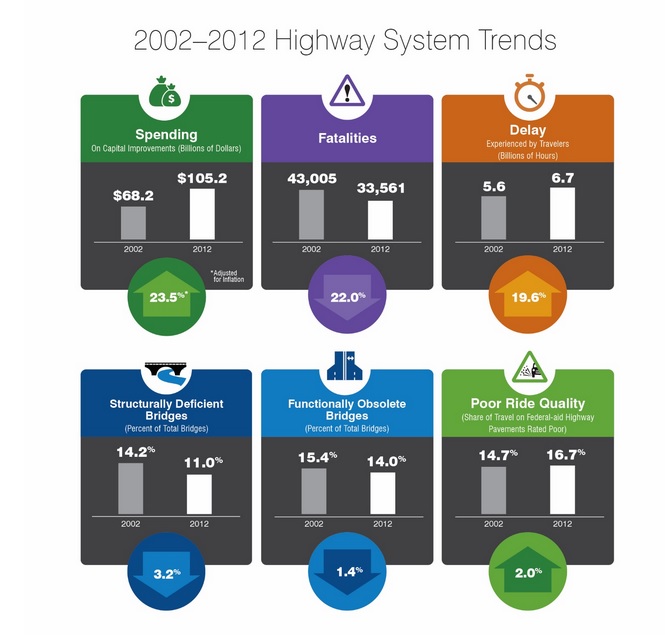

According to the FHWA report, capital spending on roads by all levels of government increased by 23.5 percent in inflation-adjusted terms between 2002 and 2012.

What did we get for that money? A helpful FHWA infographic tells the story:

Source: Federal Highway Administration, 2015 Conditions and Performance report

The big win over the decade between 2002 and 2012 was the decline in traffic fatalities, though this is likely much more the result of safety improvements in cars and reductions in drunk driving than infrastructure investment. The decade also saw the nation mostly hold its own in the battle to preserve the quality of its aging highway network. So far, so good.

But, if you thought a nearly one-quarter increase in highway spending would bring a reduction in congestion, think again: the number of hours drivers spent sitting in congestion (not the best measure of congestion impact, but what we have to work with) increased by nearly 20 percent over the decade.

Transportation analysts have long known that adding highway capacity does not fix congestion (especially in the long run), but this is still news to many decision-makers and much of the public. Which may explain why …

2) We Continue to Sink Tens of Billions of Dollars into Highway Expansion

Despite growing repair needs and the ever-more-apparent futility of addressing congestion through road expansion, the U.S. still spends vast sums of money to build new highways and widen existing ones. In 2012, fully one-quarter of all highway capital spending supported what the FHWA classifies as “system expansion.” Only 59 percent flowed toward system rehabilitation, with another 15 percent spent on “system enhancements.” The $27 billion spent on highway expansion in 2012 is lower both in real terms and as a share of the highway funding pie than it was in previous years, but it is still a massive investment of resources – more than triple the amount we spent annually on transit system expansion.

3) Drivers Are Not Paying their Fair Share

The operating theory behind U.S. highway finance has long been that drivers pay the cost of building and maintaining roads through “user fees” such as gas taxes, vehicle registrations and tolls. Drivers have never fully covered the cost of road expansion and maintenance – especially when the costs imposed on society in pollution, noise, public health and other costs are factored in – but the shifting of costs from drivers to the general public has accelerated dramatically in the last decade.

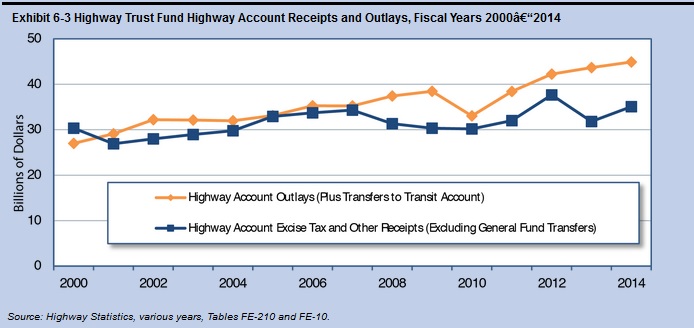

The FHWA report notes that the gap between the money deposited into the Highway Trust Fund and spending from the fund, which emerged beginning around 2000, widened dramatically beginning in 2007. (See chart below.) By 2012, so-called “user fees” covered only about half the cost of building, maintaining and operating highways.

Source: Federal Highway Administration, 2015 Conditions and Performance report

One reason for this has been the declining real value of highway “user fees” as state and federal governments have refused to make the politically difficult move of raising gas taxes. The real value of motor fuel and motor vehicle taxes (local, state and federal) in the U.S. declined between 2002 and 2012. One doesn’t need to be an accounting major to recognize that stagnating real user revenues and growing real expenses means that the money to pay for highway maintenance and expansion has to come from somewhere else. Increasingly, it is coming from general taxpayers and by incurring loads of debt.

4) Swimming in Debt

The areas of highway spending that are increasing the fastest are not expansion or maintenance, but interest on debt, which rose at a 7.9 percent average annual rate between 2002 and 2012, and bond retirements, which increased at an average annual rate of 12.8 percent. In other words, more and more of your gas taxes are going not toward building new roads or fixing old ones, but rather paying the interest and principal on the highways you already use.

There is little real prospect of this changing much in the short run. Before the state recently increased its gas tax, officials in Washington State believed that debt service would consume 70 percent of gas tax revenues by the end of this decade. Highway happy Wisconsin has seen a tripling of the amount of the gas tax dedicated to paying off debt. So it goes in state after state.

Here, then, is where we stand: The highways we built over the last couple of generations increasingly require costly maintenance and replacement. Politicians fail to increase the gas tax out of fear of angering drivers, so they shift the cost to general taxpayers and load up on debt on the assumption that the revenue to pay that debt (and keep laying new asphalt) will magically appear somewhere down the line.

Meanwhile, we keep adding to the existing highway network, incurring more maintenance and debt obligations that future generations will have to be prepared to absorb. All of this is in the service of enabling and accelerating present-day car dependence, which leaves too many of us poorer, sicker and more miserable than we ought to be, and which, through its contribution to climate change, threatens the continued health and welfare of the United States and the world.

If we continue along this course, the future is one in which highway spending eats more and more of the public budget – taking away money that might be used for education, health care or to save for a rainy day.

The arrival of a knight in shining armor – whether in the form of private sector investment or a windfall from tax reform – won’t solve the fundamental problem. Nor will raising the gas tax alone. We can only fix what is broken by taking stock of how we got here, making mature decisions that refocus our transportation dollars on the critical challenges and emerging needs of the 21st century, and then rejecting the kind of fiscal gimmickry that allows us to escape our responsibility for paying our fair share.

Authors

Tony Dutzik

Associate Director and Senior Policy Analyst, Frontier Group

Tony Dutzik is associate director and senior policy analyst with Frontier Group. His research and ideas on climate, energy and transportation policy have helped shape public policy debates across the U.S., and have earned coverage in media outlets from the New York Times to National Public Radio. A former journalist, Tony lives and works in Boston.