Auto Boom or Auto Bubble?

If car sales are being sustained in large part by a lax lending environment and cheap credit, what will happen if and when interest rates rise or when mounting losses on bad loans trigger a pull-back in lending?

By Vincent Armentano and Tony Dutzik

Previous posts in Mobility on the Installment Plan series:

1. Introduction

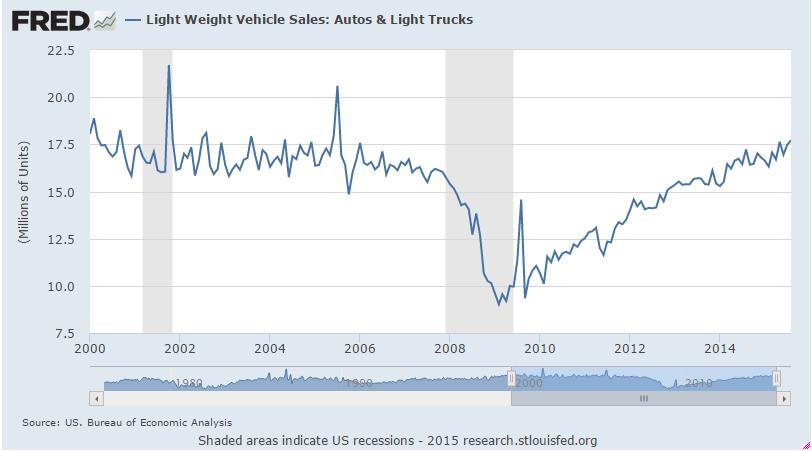

The market for light-duty vehicles (cars, vans, pickups and SUVs) is the strongest it has been in nearly a decade. This past May, consumers purchased vehicles at an annualized rate of 17.6 million vehicles, the fastest pace since 2006. At the bottom of the recession in February 2009, by contrast, just 9 million vehicles were sold.

Source: Federal Reserve Economic Data

The resurgence of automobile sales is notable – in part because it may be contributing to renewed growth in the number of vehicles per licensed driver, a figure that hit an historic high of 1.24 in 2006 before declining to 1.21 in 2013.[1] In July, the consulting firm IHS reported that the total number of registered light-duty vehicles in the United States had hit a new high.

By historical standards, the recent “boom” in auto sales is not dramatic – returning us essentially to the annual sales levels of the early 2000s, despite population and GDP growth since that time. But a deeper look suggests that, while the recent level of car sales may not be historically unusual, the consumer lending boom that has helped fuel that surge is new.

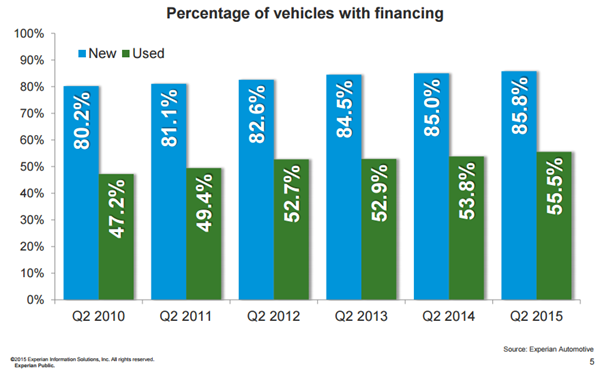

The share of vehicle sales that are financed is hitting new heights, after falling during the recession. For new cars, nearly 86 percent were financed in the second quarter of 2015, compared with 80 percent in 2008. The percentage of used cars financed has increased as well, to nearly 56 percent. If you happen to pay cash for a car – any car – you are in a small and dwindling minority.

Source: Experian Automotive’s State of the Automotive Finance Market, Second Quarter 2015 Report

Lending standards have also been loosened, producing stories of shady lending practices and in-over-their-heads borrowers that eerily echo those heard during the housing crisis. The Center for Responsible Lending’s January report, Reckless Driving, states that underwriting standards have become much looser since the recession, leading to a surge in subprime lending.

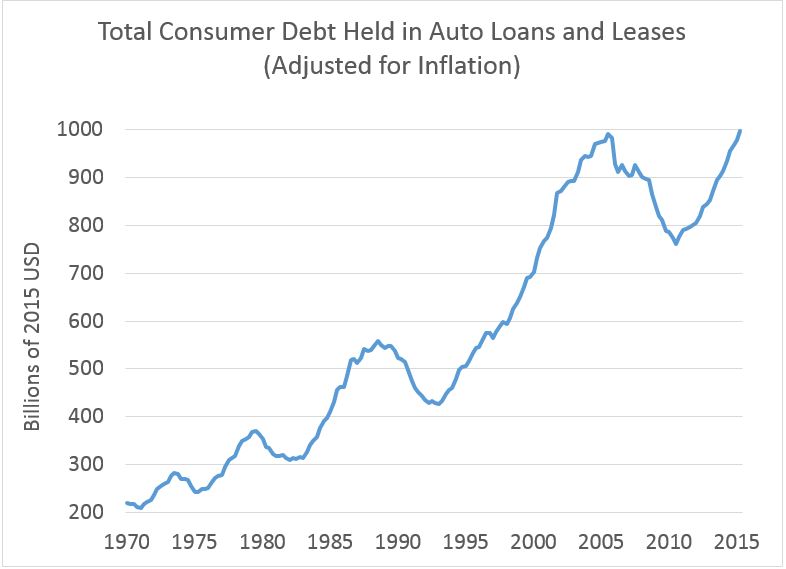

The result of the surge in auto sales and loosening of lending standards is that consumers now find themselves holding record levels of auto debt: roughly $1 trillion. Adjusted for inflation, the amount of outstanding auto debt recently surpassed the previous peak in 2005.

Source: Federal Reserve Economic Data, Federal Reserve Economic Data (CPI)

Is the fact that consumers are more in debt than ever for auto loans a sign that a bubble is forming? Or is this just the new normal for the auto industry? So far, with the economy good and household coffers augmented with savings from lower gas prices, auto loans seem to be holding up OK. Equifax reported in June that the severe delinquency rate for April 2015 was 0.81%, the lowest it has been since September 2005.

But there are worrying signs on the horizon. Bloomberg reported in August that losses on bonds and securities backed by subprime auto loans had risen by 1.45%, bringing the July average to 6.6%. This means that subprime borrowers are struggling to make payments as the losses on these bonds are a measure of the cost of bad debt. Bloomberg suggests that a wave of newer companies is competing fiercely for market share, bringing down lending standards.

All of which leads to a few questions. First, if car sales are being sustained in large part by a lax lending environment and cheap credit, what will happen if and when interest rates rise or when mounting losses on bad loans trigger a pull-back in lending?

Second, even if the economy remains strong and credit loose, how much longer can car companies continue to post near-record sales? How many potential customers remain who have not yet been drawn into dealerships by cheap lease deals and 0% APR financing?

Third, what happens to all those newly leveraged borrowers when the next recession hits … or when, three, four or five years hence, they find themselves owing more money on their car loans than their vehicles are worth? (Indeed, the average used car borrower is now “underwater” on his or her loan from Day 1, according to the Office of Comptroller of Currency.)

And, lastly, is there some fundamental market dynamic in which going into more debt for longer for a car might be justified? Historically, new cars have been considered terrible investments due to steep depreciation. But with today’s vehicles proving to be more reliable and more durable (as well as more expensive up front), are cars becoming assets that hold value for a longer period of time?

Easy access to cheap credit has floated the resurgence in car sales in the last several years. How long it will continue to do so remains to be seen.

[1] Based on data from Federal Highway Administration Highway Statistics series of reports.