Gideon Weissman

Former Policy Analyst, Frontier Group

For most of its history, the Consumer Financial Protection Bureau (CFPB) has stood up for consumers, including by publishing detailed analyses of financial complaints. However, the CFPB's latest report fails to include the names of companies that receive the most complaints for abusive debt collection practices. This new analysis fills in the gaps, telling the story the Trump administration won’t about the problems consumers face with debt collection agencies across America.

Former Policy Analyst, Frontier Group

Senior Director, Federal Consumer Program, U.S. PIRG Education Fund

Director, Consumer Campaign, U.S. PIRG Education Fund

Created in the wake of the 2008 financial crisis, the Consumer Financial Protection Bureau, or CFPB, has been a critical ally for consumers in the financial marketplace. Over its history the CFPB has secured $12 billion in relief for wronged consumers, provided recourse to consumers facing problems with financial companies, and taken action against companies that break the law.

The Trump administration, however, has worked to undermine the effectiveness of the CFPB, retreating from critical investigative work and seeking to slash the CFPB’s budget and limit its ability to protect consumers. The CFPB has also reduced the usefulness of its research on consumer financial complaints. Its latest such report, spotlighting debt collection complaints, does not include the names of companies that receive the most complaints for abusive debt collection practices.

An analysis of CFPB consumer complaint data fills in the gaps of the bureau’s report, telling the story the Trump administration won’t about the problems consumers face with debt collection agencies across America.

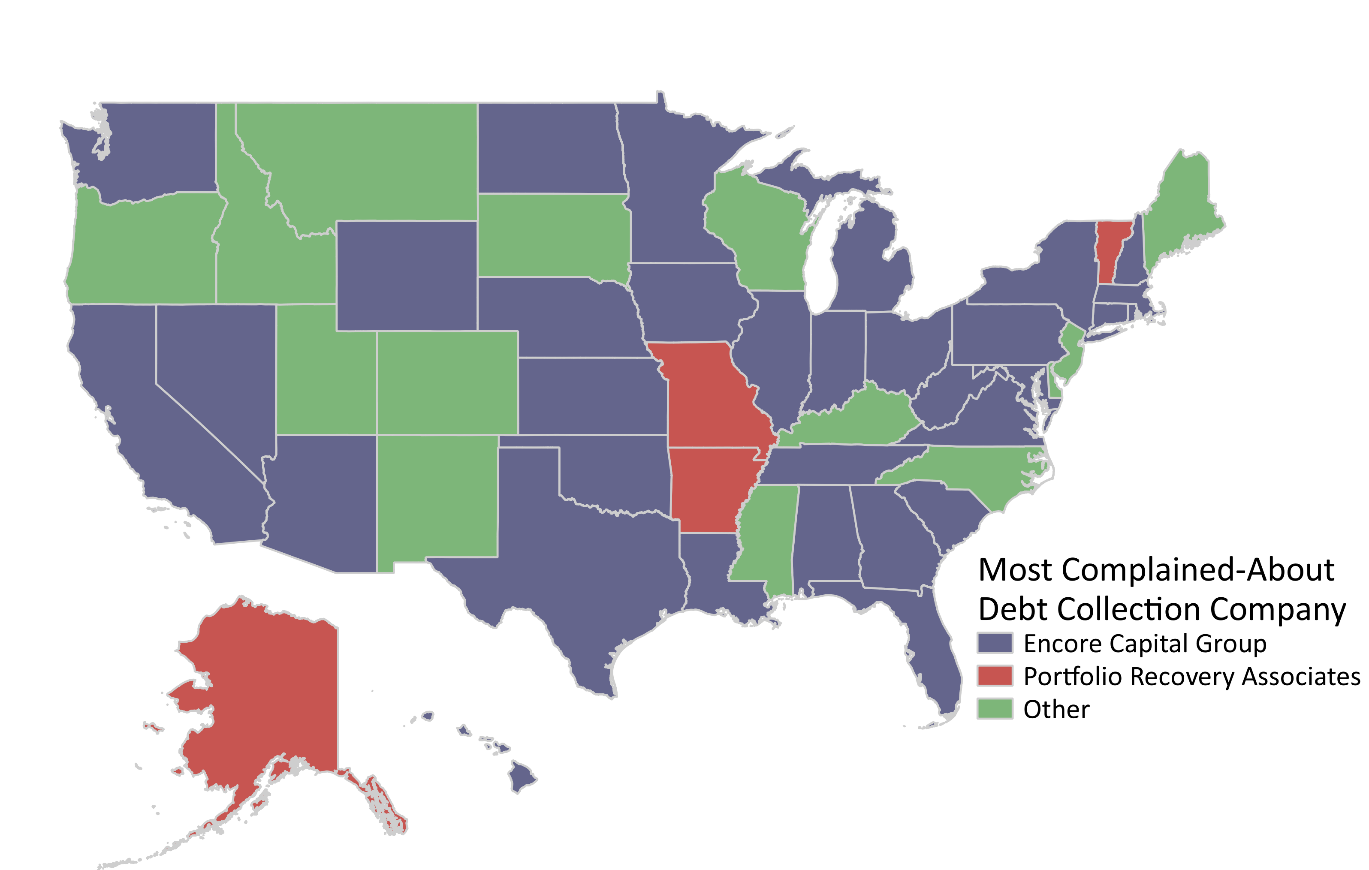

Encore Capital Group is the most complained-about debt collection company.

Georgia leads all states in debt collection complaints per capita.

With a Senate-confirmed consumer champion at its helm, the CFPB can be a powerful ally for American consumers, giving consumers recourse when they are wronged and helping to create a fair marketplace for financial services.

Under the Trump administration, the CFPB’s future has been put at risk, and its ongoing efforts to protect consumers have been severely hampered. To ensure American consumers are protected in the financial marketplace, the president should swiftly nominate a consumer champion to the director position of the CFPB. Policymakers should oppose attempts to defund or defang the CFPB, even if recommended by its acting director.

To fulfill its mission of protecting consumers, the CFPB should:

Figure ES-1. Encore Capital Is the Most Complained-About Company in 32 States

Former Policy Analyst, Frontier Group

Ed oversees U.S. PIRG’s federal consumer program, helping to lead national efforts to improve consumer credit reporting laws, identity theft protections, product safety regulations and more. Ed is co-founder and continuing leader of the coalition, Americans For Financial Reform, which fought for the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, including as its centerpiece the Consumer Financial Protection Bureau. He was awarded the Consumer Federation of America's Esther Peterson Consumer Service Award in 2006, Privacy International's Brandeis Award in 2003, and numerous annual "Top Lobbyist" awards from The Hill and other outlets. Ed lives in Virginia, and on weekends he enjoys biking with friends on the many local bicycle trails.

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.