Gideon Weissman

Former Policy Analyst, Frontier Group

The findings of our new report, Older Consumers in the Financial Marketplace, suggest that mistreatment of older consumers by financial companies is widespread – but also that older consumers would be worse off, and more vulnerable to predatory companies, if not for the work of the Consumer Bureau.

Former Policy Analyst, Frontier Group

When the Consumer Financial Protection Bureau, or Consumer Bureau for short, opened its doors in 2011, consumers were still reeling from the financial meltdown. Since that time, the Consumer Bureau has fulfilled its mission of protecting consumers in the financial marketplace. It has cracked down on bad actors like robosigning lenders, slammed Wells Fargo for illegally opening unauthorized customer accounts, and provided valuable resources for consumers having trouble with products like mortgages, bank accounts, and credit reports.

One of the most important functions of the Consumer Bureau is standing up for vulnerable groups of consumers. The bureau was created with special offices to protect four groups in particular: servicemembers, students, the economically vulnerable, and older consumers.

Today, Frontier Group is releasing new research focused on that last group – older consumers. As consumers age they can face increased risk in the financial marketplace. The types of risk they face are wildly diverse, reflecting the diverse population of older consumers. Some face risks because of their accumulated wealth, including equity in their homes. Others are vulnerable due to health problems, or because they lack a steady source of income and resort to using inherently risky financial products. The potential for problems is amplified by predatory businesses looking to take advantage of older Americans, whether by targeting them with misleading ads, charging unfair fees, or offering overpriced or unnecessary financial products.

The findings of our new report, Older Consumers in the Financial Marketplace, suggest that mistreatment of older consumers by financial companies is widespread – but also that older consumers would be worse off, and more vulnerable to predatory companies, if not for the work of the bureau.

For consumers facing problems with financial companies, one of the most important resources the Consumer Bureau offers is its ability to receive, and then act on, consumer complaints. In addition to helping consumers resolve their issues, the bureau also makes these complaints publicly available for research purposes.

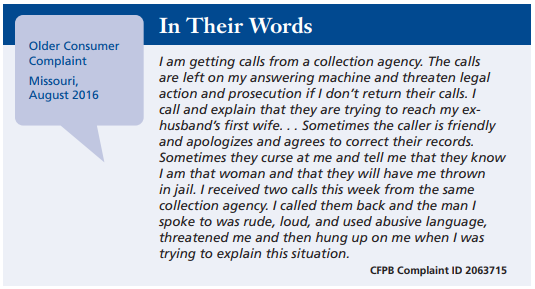

In our analysis of 72,000 complaints submitted by older consumers, we found that the products that have received the most complaints from older consumers are mortgages, debt collection, and credit reports. These products accounted for 31, 17 and 17 percent of complaints, respectively. The stories told in the narratives accompanying some of the complaints reveal frustration and hardship caused by both predatory companies and complicated, risky products. Our report highlights some of these stories, like the following:

Although this report turns up problems, we also found good news: The bureau is taking action against many of the most complained-about companies, protecting countless older consumers in the process. For example, of the 10 mortgage companies that received the most complaints from older consumers, five have been the subject of mortgage-related Consumer Bureau enforcement actions. And all of the big three credit reporting agencies – Equifax, Transunion and Experian – were the subject of enforcement actions in 2017 alone for misleading consumers about the value of the credit reports they sold to consumers.

Despite the enormous benefits that older consumers, and all Americans, have derived from the Consumer Bureau, it remains under threat. The words of consumers that have been helped, however, shows that the Consumer Bureau provides an invaluable service – and that weakening the Consumer Bureau would needlessly put vulnerable Americans in harm’s way.

Former Policy Analyst, Frontier Group