Cheap Gas or Loose Money? What’s Behind the Surging Sales of SUVs?

If you had ever aspired to own a big, luxury SUV or wanted to buy a tricked-out new pickup for work, 2015 has been your year.

Cheap gasoline has not been an economic panacea for the U.S. For households, low gas prices have provided a bit of extra cash to spend. But with the United States now a significant fossil fuel producer, the collapse of world oil prices is casting a long shadow over the same regions that, until a year ago, were in the midst of a fracking-driven economic boom.

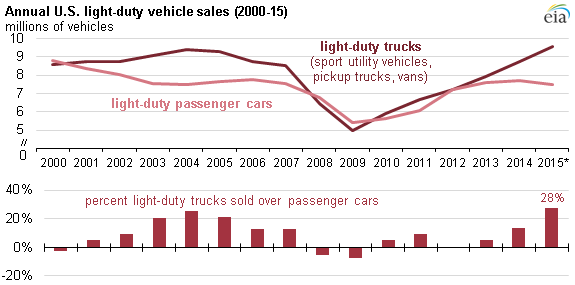

Environmentally, of course, low gas prices come at a heavy cost– slowing the adoption of electric cars, incentivizing people to drive more, and spurring sales of gas-guzzling cars and SUVs. Two recent stories – in the New York Times and City Observatory – make the connection between low gas prices and rising sales of low-mileage vehicles such as SUVs, a phenomenon that has previously been documented by the Energy Information Administration and others.

Source: Energy Information Administration

There is more to the rising sales of SUVs than just cheap gas, though. As we’ve documented in our Mobility on the Installment Plan blog series (links below), recent years have seen dramatic shifts in the market for car loans, with lenders offering bigger loans at lower interest rates repaid over longer terms than ever before. As we’ve said before, it has never been cheaper to climb into an expensive car.

Third quarter data from Experian tell the tale: The percentage of new vehicles that are financed (versus purchased with cash) has reached 87 percent – a record. The average amount financed for new vehicles is now approaching $29,000, another record. The average repayment term of a new car loan has reached a record 67 months, and more than a quarter of all new car loans carry a repayment term of greater than six years – something that was unheard of until very recently.

Auto dealers and finance companies are using low interest rates and long repayment terms to reduce the monthly payment for consumers, making bigger, more expensive vehicles appear more affordable to those on a monthly budget. Never mind that many car buyers will find quickly find themselves “underwater,” owing much more on those SUVs than they are worth … or the concerning increase in the volume of outstanding loans in the subprime portion of the market … or the U.S. Comptroller of the Currency’s warnings that the situation in the auto lending market “reminds me of what happened in mortgage-backed securities in the run up to the crisis.”

Put simply, if you had ever aspired to own a big, luxury SUV or wanted to buy a tricked-out new pickup for work, 2015 has been your year.

In fact, 2015 has been an automobile bonanza on several fronts, with gasoline nearly cheaper than water, Congress continuing to refuse to make drivers pay for the roads they use, and auto lenders throwing cash at nearly anyone willing to take it. But what won’t last, can’t last, and there is much about the recent auto boomlet that is profoundly unsustainable.

Low gas prices have certainly shaped consumers’ vehicle purchase decisions. So too has the loosening of traditional standards for auto lending. With the oil industry now in the midst of a painful rebalancing and the Fed considering raising interest rates for the first time in almost a decade, it is anyone’s guess as to how long either condition will last.

*****

Other posts in the Mobility on the Installment Plan series:

Authors

Tony Dutzik

Associate Director and Senior Policy Analyst, Frontier Group

Tony Dutzik is associate director and senior policy analyst with Frontier Group. His research and ideas on climate, energy and transportation policy have helped shape public policy debates across the U.S., and have earned coverage in media outlets from the New York Times to National Public Radio. A former journalist, Tony lives and works in Boston.