Auto-Mobile Banking vs. Mobile Banking

As customers replace automobile banking with mobile banking, Bank of America closes drive-through tellers.

by Ben Davis

Another sign of America’s shift away from the automobile: Bank of America is closing drive-through tellers between Georgia and Texas. One of the reasons: customers are replacing automobile banking with mobile banking.

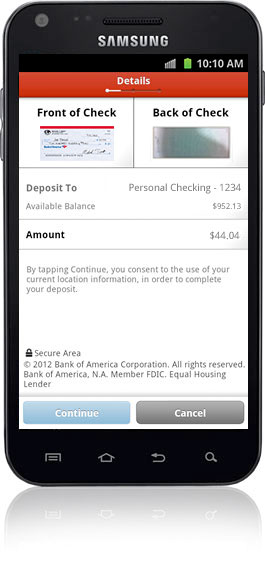

Today, 13 million customers bank using smart phones and 29 million bank using online services. Bank of America processes 160,000 checks per day via an app in which customers take a picture of the check – never needing to step foot in a branch or drive up to a teller.

What’s going on is that the ability, convenience and popularity of not just depositing a check, but transferring money, reviewing your credit card statement, and paying bills with a few clicks has made drive-through tellers so 20th century and essentially obsolete. With so few customers using the teller lanes, closing them was a logical step for BofA.

Two quick observations:

First, what’s neat about mobile banking enabling us to manage our finances without driving to a bank is that it is representative of a larger trend of technology enabling us to do things that once required driving. As our report on technology and driving that will be released later this month will highlight (stay tuned), the same technological advances that enable us to bank from home have also opened the door for car-sharing, bike-sharing and real-time transit information, which all make driving a personal car a much less attractive alternative.

Second, while everyone knows that Americans are driving less (the average American drove 6 percent fewer miles in 2011 than in 2004), a big question is how strongly this trend will persist into the future. And considering that mobile banking and other technology isn’t going to magically disappear anytime soon – I’m putting my money (via my iPhone if I could) on this trend continuing strong.