What’s wrong with buy now, pay later? The risks of the newest tool to pull you into debt

Buy now, pay later apps give consumers the flexibility of paying for purchases in installments, but that convenience comes at a cost. Besides being unregulated and full of fine print, these companies have one ultimate goal: get you to buy more stuff, and go into debt to do it.

Infomercials have long offered us ways to pay for our egg cookers, hair trimmers and Bavarian knife sharpeners with just 4 easy installments of $19.99 if you call now. But paying for impulse buys on the installment plan has found new life far beyond those “as seen on TV” ads, thanks to the rise of “buy now, pay later” (BNPL) apps.

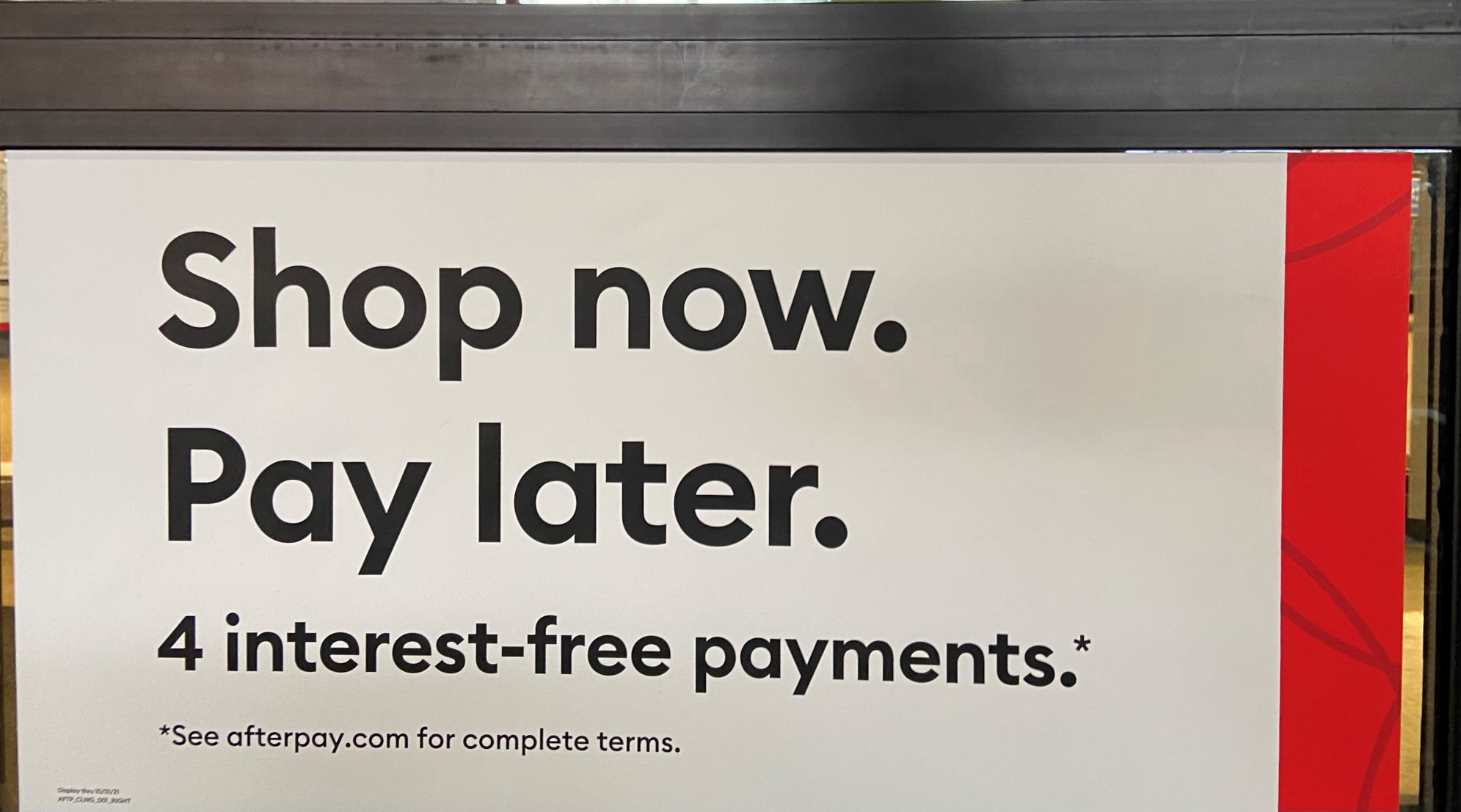

New firms like Afterpay, Klarna and Affirm — along with more established companies like PayPal (through its new feature, Pay in 4) – have made BNPL an option at checkouts in brick-and-mortar and online stores alike. The apps offer payment plans for all sizes of purchases, allowing customers to obtain an item now and then pay the bill for it in installments over 4 or 6 weeks. Most of these services are interest-free and carry no fees – until you miss a payment, that is.

The use of BNPL apps is exploding. Over the 2021 Black Friday shopping season, there was a 400% increase in the use of BNPL apps to finance purchases. And they’re surprisingly widespread; according to the Consumer Financial Protection Bureau, over 40% of Americans have used a BNPL app.

New partnerships between retailers and BNPL apps are being announced seemingly every day. Users can now use Afterpay for purchases at familiar stores like Target and Bath and Body Works, while earlier in 2021, Affirm landed a contract with Amazon to offer their BNPL services at checkout. The BNPL companies receive a fee from retailers for offering their payment plans to customers. And the retailers? They’re betting on increased sales. According to one UK consumer group’s investigation, BNPL companies “often market themselves to retailers on the basis that people spend more when they use buy now, pay later.”

And they seem to be right. One survey of BNPL users found that two-thirds reported buying more than they otherwise would have if they had to pay the total upfront. Another survey heading into this end-of-year shopping season found that “those who plan to use BNPL this holiday season plan to spend more – more than last year, and more than their non-user counterparts.” It makes sense why breaking up the bill into smaller installments lends itself to buying more stuff – as some young consumers shared in interviews with CNBC, using BNPL services just makes purchases “sound cheaper.” It’s the same phenomenon we’ve written about here at Frontier Group in the world of auto loans – a longer loan term shrinks the monthly payment, giving some consumers the impression they can afford more car than may really be a good idea.

While BNPL may offer some consumers flexibility that can be helpful during hard financial times, there are downsides. If you miss a payment, many of the apps have late fees that kick in, while others apply interest rates reaching as high as 30%. Missing payments may cause BNPL debt to be turned over to debt collectors, or end up as dings on a consumer’s credit report. These repercussions are not uncommon in the BNPL world; more than 7 out of 10 BNPL customers have faced late fees or interest rate charges. According to one study, 72% of those who had fallen behind on BNPL payments saw their credit score fall as a result.

Concerningly, BNPL products fall outside the bounds of some of the most important consumer protection laws that shield people from predatory or deceptive lending practices. For example, because of the typically 4-installment repayment windows, many of these companies aren’t currently covered by the Truth in Lending Act, which requires “5 installments” before the regulation is triggered.

Make no mistake – though you won’t see the words “loan” or “debt” on BNPL marketing materials, this is what these services really are, and they should be regulated as such. Other countries such as the U.K. are seeking to regulate BNPL providers as lenders or credit brokers, and the state of California now classifies many BNPL agreements as loans.

While the lack of regulation is a huge problem that’s making it easy for people to accidentally put their financial health at risk, there’s a bigger problem at play here, too, and it’s the kind that keeps me up at night. BNPL takes advantage of a new normal in the American consciousness: indebtedness as a daily fact of life.

Americans are seriously in debt. As of the third quarter of 2021, Americans owed a total of more than $15 trillion, nearing the highest in U.S. history. This debt includes things that have the potential to be so-called “good” debt – the kind of debt you take on as an investment that increases your capacity for the long term, like a loan for a reasonably-priced house or a college education. But it also includes debt that might provide short-term pleasure, but leaves borrowers repaying long after the initial buzz is gone. Heading into this year’s holiday shopping season, 1 in 3 Americans anticipated taking on debt just to complete their shopping. BNPL joins credit cards as a way to finance a momentary hit of pleasure, like buying a must-have you didn’t know you needed until that targeted Facebook ad.

BNPL plays on some of our worst impulses, and does so knowingly. You only need to take a quick look at a 2017 report the BNPL firm Klarna did on “Emotional eCommerce” to see how companies can seek to weaponize the psychology of a shopper to induce them to buy more, and do so often. The report states that spontaneous purchases “often resulting from lapses of self-control, inner strength or resolve can be lucrative for retailers.” It offers ways online retailers can make the checkout process frictionless to encourage shoppers to overcome hesitations about their impulse purchases. Naturally, offering BNPL services is one of the report’s suggested solutions.

Paying for stuff in installments is not new. But adding a significant technological backend that enables new heights of convenience is worth pausing over. In a world where millions of us are drowning in debt and our environment is drowning in the waste from all the stuff we manufacture and buy, it’s worth asking whether creating less friction in exercising our consumerist urges is really worth celebrating. As long as BNPL exists, consumers need to be protected from abuse, the same as any other loan. But with the bills from this holiday season starting to come due, there’s no better time to revisit whether America’s increasingly casual approach to debt is doing us or society any favors.

Topics

Authors

R.J. Cross

Policy Analyst, Frontier Group

R.J. focuses on data privacy issues and the commercialization of personal data in the digital age. Her work ranges from consumer harms like scams and data breaches, to manipulative targeted advertising, to keeping kids safe online. In her work at Frontier Group, she has authored research reports on government transparency, predatory auto lending and consumer debt. Her work has appeared in WIRED magazine, CBS Mornings and USA Today, among other outlets. When she’s not protecting the public interest, she is an avid reader, fiction writer and birder.

Find Out More

Beyond the politics of nostalgia: What the fall of the steel industry can tell us about the future of America

Bumbling toward utopia

What’s wrong with the systems we rely on?