Natural Gas: Predictably Unpredictable

The natural gas industry would like nothing better than for the United States to make a series of investments in infrastructure that will keep us locked into natural gas-dependence for decades – just as we did, fatefully, in the power plant building boom of the late 1990s and early 2000s. That, I fear, would be a big mistake, and not just for the environment.

Natural gas prices are now at the lowest level in roughly a decade. And that’s in nominal terms – adjusted for inflation, natural gas is about as cheap as it has been at any time in recent history.

The decline in natural gas prices is attributed largely to boom in shale gas development brought about by the spread of horizontal drilling combined with hydraulic fracturing – the process known colloquially as “fracking.” Our research on the issue suggests that fracking poses more than its share of threats to the environment and public health. But that’s not the topic of this blog post.

Rather, this post is about the flurry of decisions now being made by private investors and public officials on the assumption that low natural gas prices are here to stay. Some of these decisions, especially the recent wave of retirements of polluting coal-fired power plants, are welcome and long overdue. Others, such as efforts to increase the use of natural gas in vehicles, are less exciting.

What’s incredible about this turn of events is that the nation is right back where it was in the late 1990s, when natural gas was also historically cheap and assumed to remain so indefinitely. Things then didn’t turn out as planned and it’s important to understand why.

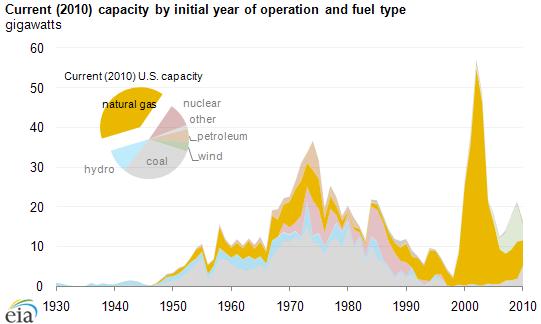

The assumption of cheap natural gas prices was one of the key forces driving states to deregulate their electricity industries in the 1990s. Deregulation, in turn, enabled a burst of construction of new natural gas-fired power plants to take advantage of all that cheap gas. (See chart below.) It was only a matter of time, it was assumed, before old nuclear and coal-fired power plants would give up the ghost, and an era of cheap, clean power in competitive markets would prevail.

Back in those days, Frontier Group analysts such as Brad Heavner and Elizabeth Ridlington warned California and other states against overdependence on natural gas. In a series of reports called Predictably Unpredictable, published between 2001 and 2003, we urged the development of renewable energy resources that are immune to the intense volatility of fossil fuel markets.

As it turned out, the increased demand for natural gas sparked by power plant construction caused prices to shoot up. Wellhead natural gas prices varied by a factor of five (!) between 2002 and 2008. Electricity bills in newly gas-dependent areas like the Northeast went through the roof. Brand-new natural gas-fired power plants sat idle as they could not produce electricity competitively. And let’s not even get into Enron. Soon, utilities were talking about a “coal rush” of new coal-fired power plants and plans for new LNG import terminals were springing up on both coasts.

The shale gas boom wasn’t on the radar screen then, but the basic boom-bust dynamics of fossil fuel based economies were on full display and have not fundamentally changed. Over the last year, some natural gas industry observers have begun to whisper the “b-word” (bubble), highlighting the speculative nature of much of the shale gas boom and the difficulty of making fracking pay amidst record-low gas prices. A shake-out of the industry appears overdue and what that will mean for production and prices is anyone’s guess.

The natural gas industry would like nothing better than for the United States to make a series of investments in infrastructure that will keep us locked into natural gas-dependence for decades – just as we did, fatefully, in the power plant building boom of the late 1990s and early 2000s. That, I fear, would be a big mistake, and not just for the environment.

Renewable energy isn’t just clean and domestically produced. It is also available at a more-or-less fixed cost, buffering consumers and the economy from the volatility of fossil fuel prices. In an era when short-term thinking often triumphs over long-term planning, renewables are a good long-term bet, and public policy should continue to drive toward increased integration of renewables into our power system, regardless of the short-term cost of gas.

Mark Twain once said that history doesn’t repeat itself, but it does rhyme. We know that fossil fuels in general – and natural gas in particular – have historically experienced dramatic price volatility. Renewable energy gives us the chance to write a new stanza for our energy system, if we keep our eyes on the long view.

Authors

Tony Dutzik

Associate Director and Senior Policy Analyst, Frontier Group

Tony Dutzik is associate director and senior policy analyst with Frontier Group. His research and ideas on climate, energy and transportation policy have helped shape public policy debates across the U.S., and have earned coverage in media outlets from the New York Times to National Public Radio. A former journalist, Tony lives and works in Boston.