Maine Launches Its New Transparency Website

Today, Maine – one of the states that has lagged behind in transparency – launched Open Checkbook, officially joining the ranks of states that provide recipient-specific government spending information in a user-friendly database.

by Ben Davis

The ability to see how government uses the public purse is fundamental to democracy. In recent years – as outlined in our annual Following the Money reports – state governments across the country have opened their checkbooks to the public by creating online transparency portals. This transparency checks corruption, bolsters public confidence, saves money, and promotes fiscal responsibility.

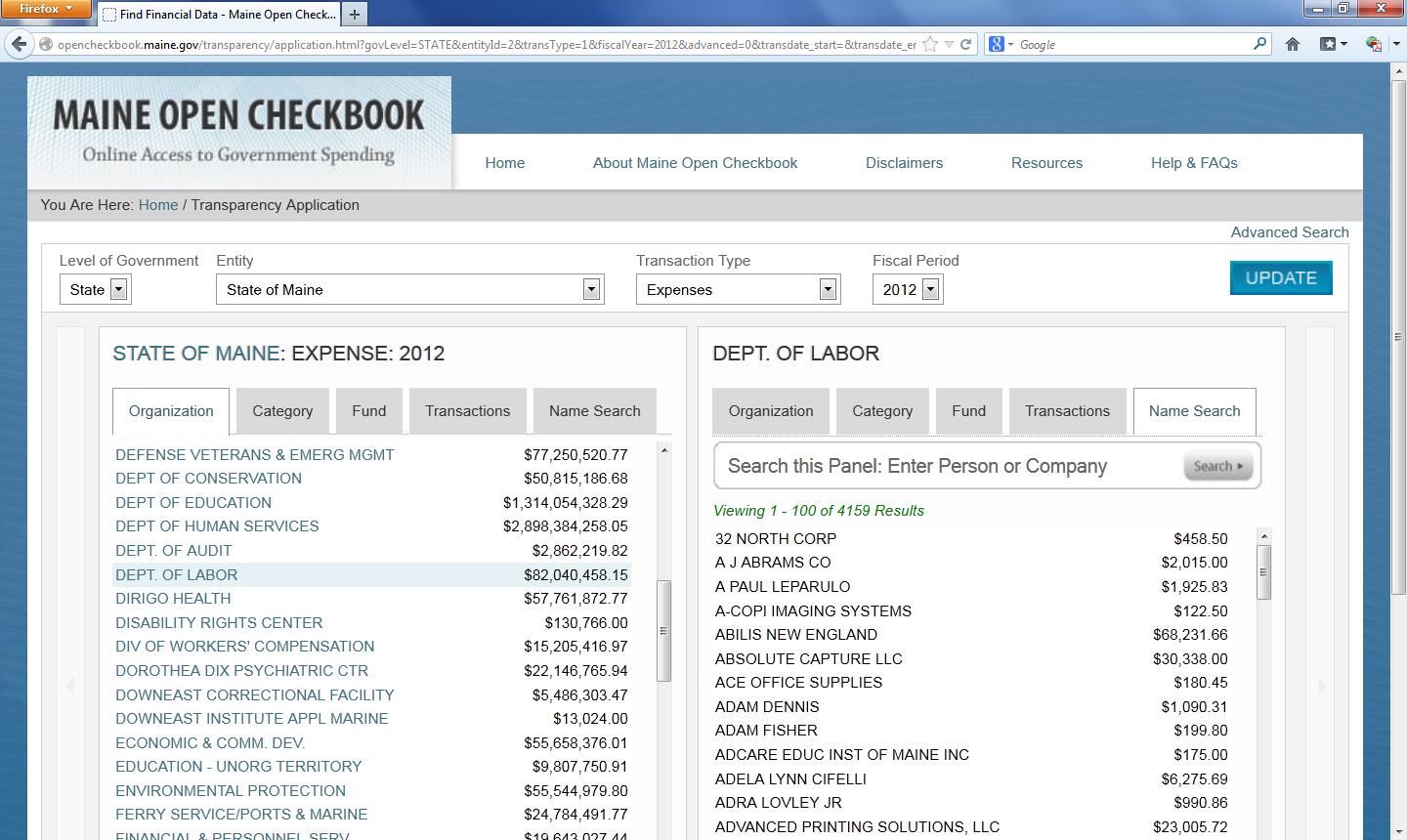

Today, Maine – one of the states that has lagged behind in transparency – launched Open Checkbook, officially joining the ranks of states that provide recipient-specific government spending information in a user-friendly database.

Maine’s online spending transparency has come a long way in recent years. In 2011, Maine was the least transparent state in the country because spending information was not available to the general public. Last year, in an effort to provide some state spending information online, the controller’s office made a few datasets of government expenditures available, but the data were outdated and unsearchable.

Maine’s new checkbook is both comprehensive and user-friendly. For FY 2012 alone, it contains over $7 billion in expenditures, and is searchable by 103 state agencies and offices, 43 spending categories, 33 purchasing funds, and more than 58,000 vendor names. Users can layer searches on top of each other to parcel the data into understandable pieces of information. For example, users can search for payments made by the Department of Education (agency) on equipment (category) through the General Fund (purchasing fund). This brings an unprecedented level of transparency over state spending to Maine residents.

Even with Maine’s new website, the state has room for improvement. While the values of payments made through individual grants are listed, the recipient names are not available. This lack of transparency prevents the public from uncovering which vendors received more than $660 million of grants in FY 2012. Payments made by quasi-public agencies – such as the Maine State Housing Authority – are not available on the checkbook. The values of credits awarded through economic development programs – such as the $1.4 million Seed Capital Investment Tax Credit program (see page 20 of the tax expenditure report for more information) – are not available on the checkbook either.

According to the controller, later stages of the website will likely publish recipient-specific expenditures on grants, quasi-public agencies, and tax credits, and Maine’s high quality checkbook platform is built so it can be upgraded accordingly. For example, the checkbook tool already contains a dropdown menu that prompts users to select a spending “Entity.” If the controller’s office was to add individual quasi-public agencies as an “entities” – the quasis’ expenditures would be as searchable as the state’s normal expenditures without creating a new platform.