Greetings from Tax Land: Is Postcard Filing the Future of Simpler Taxes or the Past?

Real tax filing simplification wouldn’t look like a postcard. Measures such as electronic filing and pre-prepared returns would do much more save Americans time, money and stress.

A new poll released only two days before the passage of the Tax Cuts and & Jobs Act showed nearly two-thirds of Americans believed the new tax bill was not designed with the average American in mind. That poll was only the most recent among many documenting worsening public opinion of GOP tax reform efforts over the last two months.

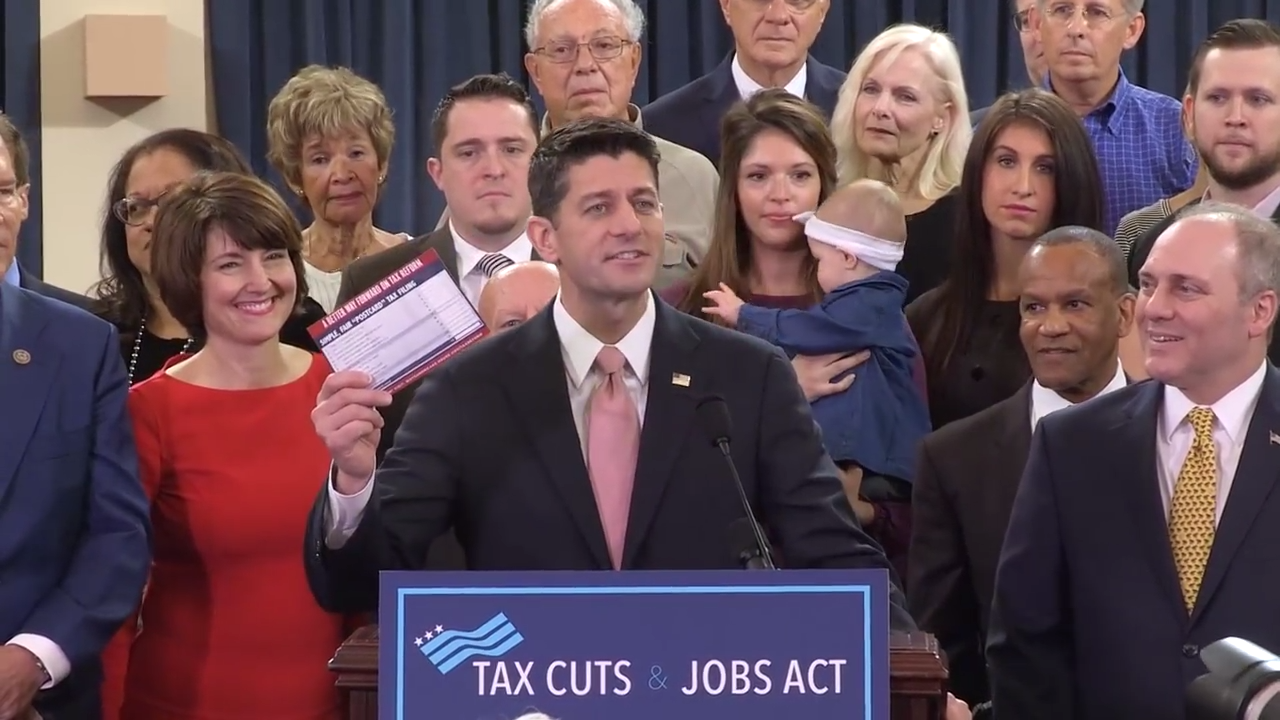

To those skeptical Americans, congressional leaders celebrating their triumph earlier this month had a question intended to regain their loyalty and support: How would you like to file your taxes on a postcard?

Under the recently adopted tax bill, a few more Americans will have the ability to file taxes by postcard. Many will still navigate reams of IRS forms. But all of us will still have to take the time to fill our taxes out from scratch – an increasingly archaic process that sucks billions of hours of time and billions of dollars from our pocketbooks each year.

Let’s be blunt: the current way we file our taxes in America is terrible. For one thing, the filing process is time-consuming; the IRS estimates an individual spends an average of 12 hours keeping records and filling in forms, and White House estimates have found taxes to be a national time sink of 7.6 billion hours annually, not far off from the 8 billion hours American spend stuck in traffic each year. Filing can also be expensive; the online download of TurboTax currently costs $54.99, not counting the $39.99 state filing fee and sporadic plan price hikes the software has been known to institute. If you’re less willing to puzzle through itemized deductions on your own, you’ll pay more; in 2016, using a professional preparation service cost Americans an average of $273 each.

This resource-intensive filing process is not only a regular feature of American life – it’s a feature that is becoming uniquely American. Currently, 36 countries give at least some taxpayers the option of receiving a completed tax return in the mail using income information the government already has to collect from employers anyway. If you have changes, you can make them straight on the form, and if not, you simply sign and mail your return back. In 2005, California implemented a similar pilot program, giving 50,000 residents the chance to receive state-completed tax forms in their mailbox. The satisfaction rate with the program, known as ReadyReturn, was an incredible 98%.

It’s true that the pain of filing taxes lies mostly with the fact that the U.S. tax system is uniquely complex with its plentiful loopholes, deductions and exemptions. The oft-repeated claim that under the tax bill nine out of 10 Americans will be able to file their taxes on a postcard rides on the introduction of a higher standard deduction, a move projected to allow more households to select that instead of puzzling through other credits and deductions. That is still a long way, however, from a tax filing process that truly relieves Americans’ annual April anxiety; 70 percent of H&R Block customers select the standard deduction and yet still choose to take their taxes to a specialist each year.

Regardless of how you feel about the substance of tax policy, simplifying the tax filing process would make a huge impact for relatively little effort. But real simplification, it turns out, is politically harder than it should be. The incomprehensible complexity of tax filing has created an entire industry with a vested interest in keeping things complicated. In the last five years, Intuit, the maker of TurboTax, has spent more than $12 million on federal lobbying efforts, followed closely by H&R Block’s $11 million. They’re not worried about the postcard gimmick either; on a December conference call with Wall Street analysts, H&R Block chief executive Jeff Jones said the company was “excited by the upcoming tax season.”

Moreover, real tax filing simplification wouldn’t look like a postcard. Measures such as electronic filing and pre-prepared returns would do much more save Americans time, money and stress. But more importantly, pursuing filing reform could also fundamentally improve the relationship citizens have with their government. After California’s 2005 ReadyReturn experiment, the state received overwhelmingly positive feedback, including one participant’s comment: “Wow! Government doing something to make life easier for a change.”

Good government should actively seek to improve the world for its citizens. Simplifying taxes has often been used as a smokescreen for less-popular changes in the tax code. The postcard gimmick is just one more example.

Image: Paul Ryan displays the “Simple, Fair Postcard” at an event in November. Credit: Screenshot from Speaker Paul Ryan’s Youtube Video “$1,182 More”

Topics

Authors

R.J. Cross

Policy Analyst, Frontier Group

R.J. focuses on data privacy issues and the commercialization of personal data in the digital age. Her work ranges from consumer harms like scams and data breaches, to manipulative targeted advertising, to keeping kids safe online. In her work at Frontier Group, she has authored research reports on government transparency, predatory auto lending and consumer debt. Her work has appeared in WIRED magazine, CBS Mornings and USA Today, among other outlets. When she’s not protecting the public interest, she is an avid reader, fiction writer and birder.

Find Out More

The Buffalo Bill: New York’s $1.2 billion subsidy for the Bills’ new stadium

Our transportation finance system doesn’t work. Here’s how to fix it.

The titans of “Main Street”: Mission creep in a key Fed rescue program threatens public trust